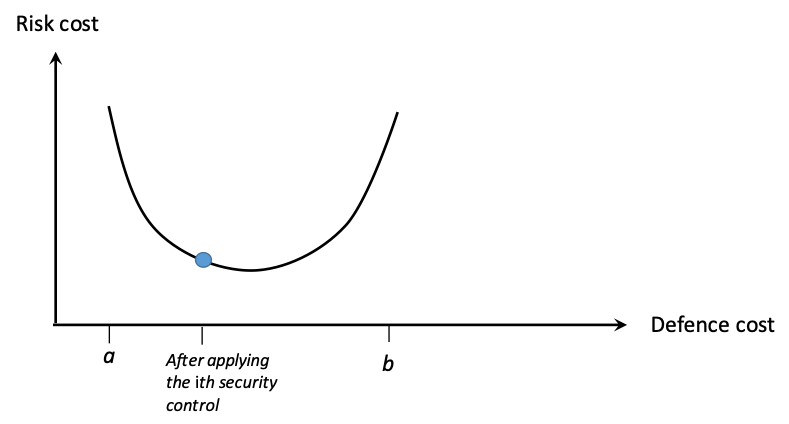

The Risk Cost principle

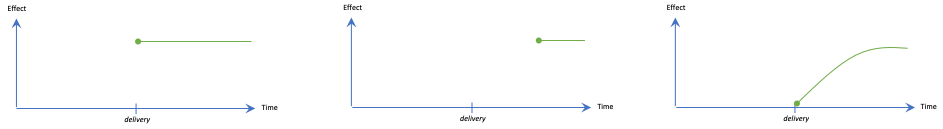

Consider an asset, something of value the organisation has or will acquire. Unprotected, the potential loss equals the value of the asset. Once you start protecting it the potential loss will first drop dramatically. Putting more defence mechanisms in place will reduce the loss probability further, but to a lesser and lesser degree. Actually, it has been shown that at some point the utility of a mitigating action is smaller than the utility of the letting the risk materialise.

Risk cost is the combination of cost of protection and the most likely losses anticipated at this defence level in a given time period, usually a month or a year.

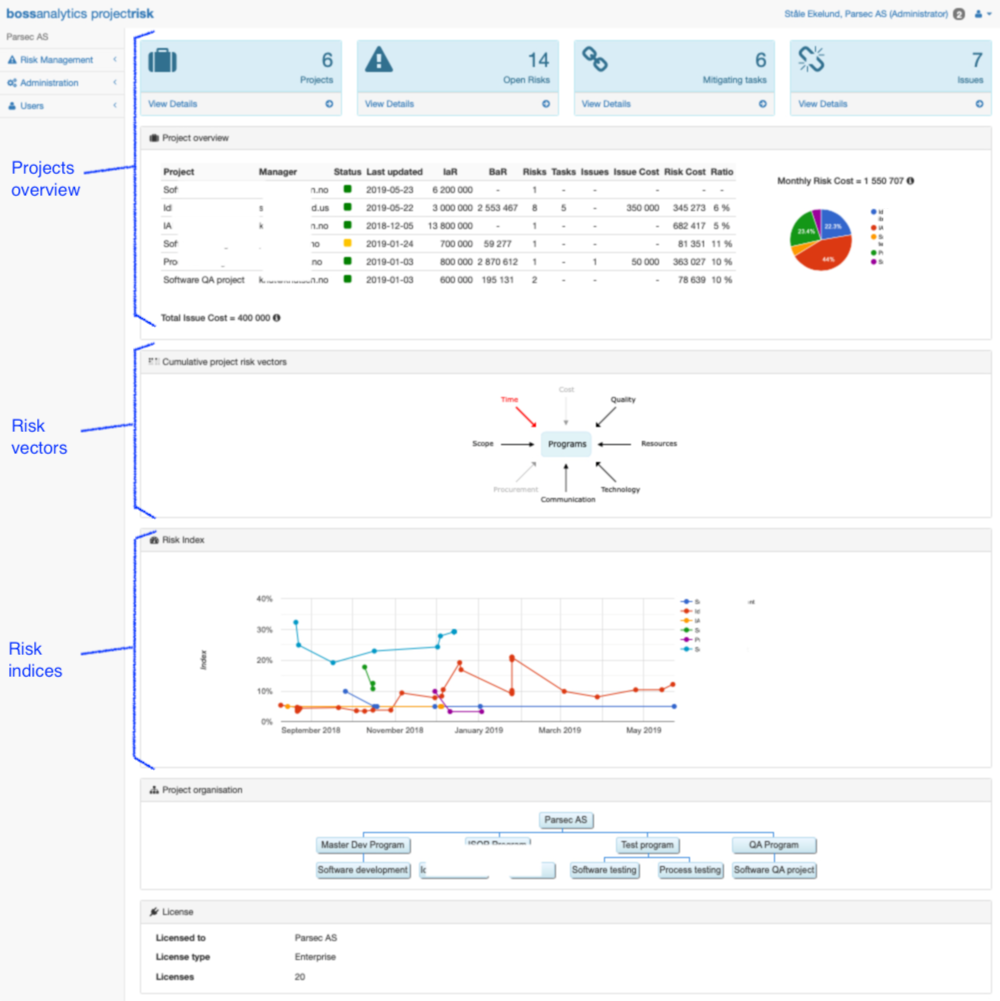

From a project's perspective, it is based on the rest value of the project, that is, budget minus earned value (Investment-at-Risk) and the portion of the benefit that is exposed (Benefit-at-Risk) plus the cost and effect of tasks.

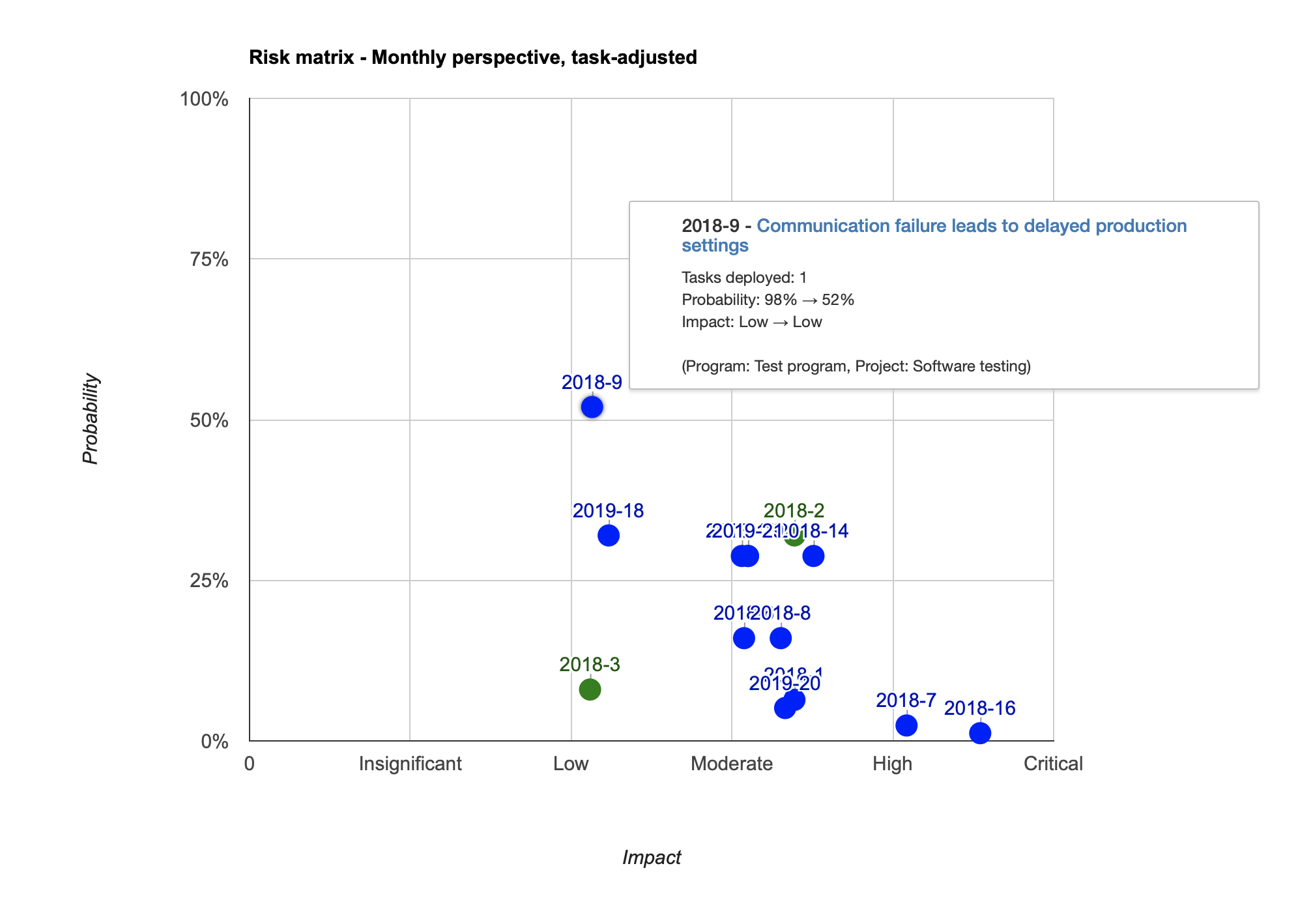

In bossanalytics projectrisk, predictive analytics is used to compute the risk cost, serving as a good indicator on how to prioritise the mitigation effort to distribute the funding where it reaps the most benefit. The higher the risk cost, the more attention it needs.

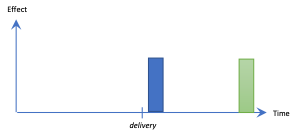

Risk cost is also in play for evaluating new mitigating tasks to render its financial utility. Based on the nature of the proposed new mitigating task and all other tasks in process, an investment advice is determined whether you should invest or not.